India Mobile Dominance: Trends, Brands, Networks, and Market Insights 2025

Updated On: November 13, 2025 by Aaron Connolly

India’s Rise to Global Mobile Dominance

India went from being a telecommunications latecomer to the world’s largest mobile market in just thirty years. With 1.2 billion mobile users and the world’s lowest data rates, India now leads in downloads, usage time, and wireless subscriptions.

Explosive Growth in Mobile Data Usage

No country on earth consumes more mobile data than India. On average, Indians use about 30GB of data every month, which is way more than most developed countries.

Data costs have dropped to just 12 cents per GB. Compare that to the global average of $1-2 per GB—it’s a huge difference.

These low prices have opened up internet access in both rural and urban areas.

Key data consumption milestones:

- 24.3 billion app downloads in 2024

- 900 million internet users nationwide

- 950 million internet subscribers

Families can now afford several devices. Students stream classes while parents use government services online. Even small businesses run entirely through mobile apps.

Surge of Wireless Subscriptions

Since 1995, mobile subscriptions have absolutely exploded. Today, India counts 117 crore (1.17 billion) telecom subscribers, making it the world’s largest mobile market.

The Indian smartphone market has over 600 million smartphone users as of 2023. That’s second only to China.

Internet penetration hit 67% by March 2024. Kerala and Telangana lead the pack in digital connectivity.

Rural areas are catching up too, thanks to programmes like BharatNet. This initiative connects over 250,000 village councils.

Most households now use mobile phones instead of personal computers. People rely on them for work, school, entertainment, and keeping in touch with family and friends.

Leading Position in Global Mobile Industry

India has taken the top spot in global mobile app downloads and time spent in apps. Even if in-app purchases lag behind Western markets, usage numbers are staggering.

The mobile broadband index ranks India among the most connected societies worldwide. Mobile networks deliver essential services, from banking to healthcare, right to people’s doorsteps.

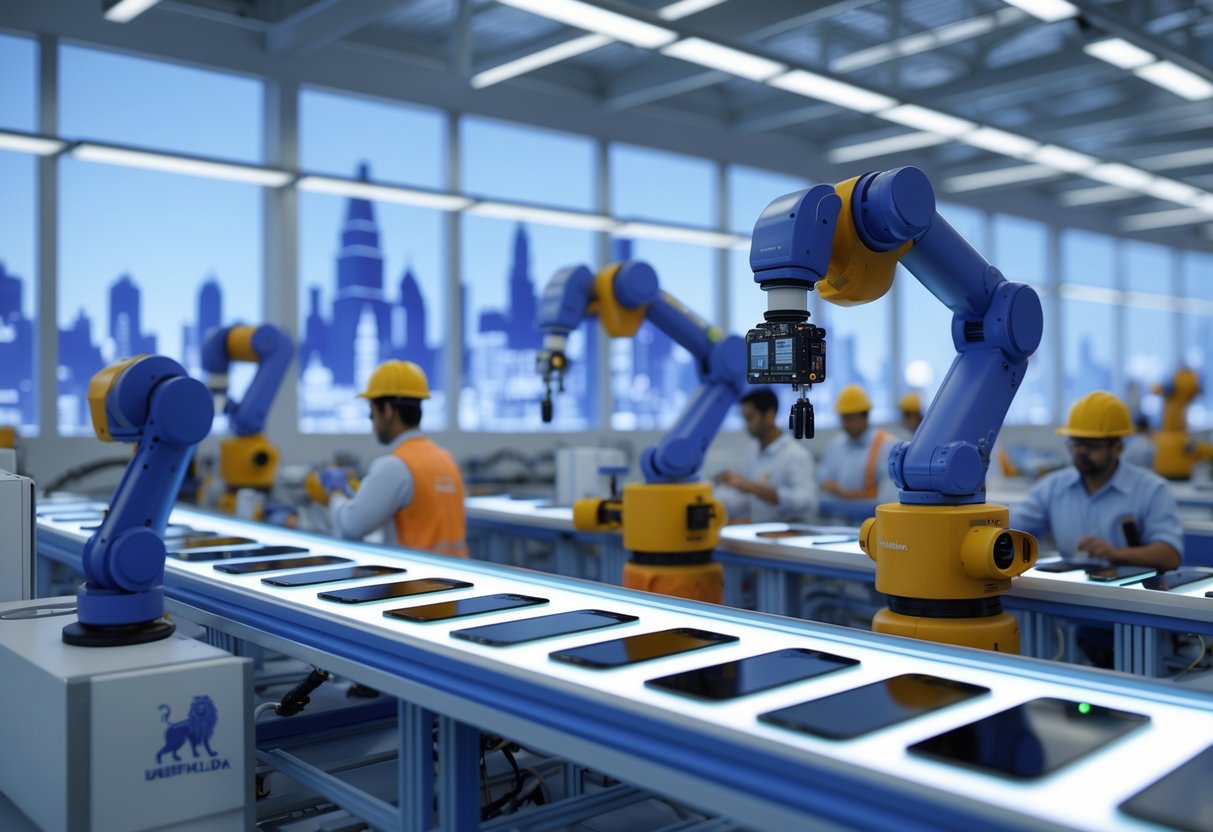

India’s impact isn’t just about usage; it’s also about manufacturing. The country has turned into a big hub for mobile device production. Exports are rising as global brands set up factories.

India’s global mobile leadership:

- Largest number of mobile users worldwide

- Lowest data costs globally

- Major manufacturing hub for devices

- Template for affordable connectivity models

Other developing countries are now looking at India’s pricing and digital infrastructure as a model. India’s become a telecommunications superpower.

Key Drivers Fueling India’s Mobile Dominance

India’s mobile revolution comes down to three big things: ultra-affordable data, government initiatives that sped up digital adoption, and a lively ecosystem of local mobile apps that changed daily life for millions.

Affordable Data and Digital Accessibility

A fierce price war between telecom operators totally reshaped India’s digital landscape. Reliance Jio’s 2016 launch pushed data prices down by more than 95% in just two years.

This massive price drop brought mobile internet to hundreds of millions. Daily data usage jumped from a few megabytes to gigabytes per person.

Key pricing milestones:

- 2015: 1GB data cost ₹250-300 ($3-4)

- 2018: 1GB data cost ₹10-15 ($0.12-0.18)

- 2024: Unlimited plans start at ₹199 ($2.40) monthly

Affordable data made rural connectivity possible at scale. Suddenly, small towns and villages could access high-speed 4G networks.

Big players like Airtel and Vodafone slashed prices to keep customers. The competition helped consumers and shook up the whole telecom sector.

People started using the internet on phones first, skipping desktop computers entirely. Most Indians never owned a PC but jumped straight to smartphones.

Government Policies and Digital India Initiatives

The 2015 Digital India programme built the groundwork for mobile-first governance and services. Policy support made mobile access a priority for all government touchpoints.

Production Linked Incentive (PLI) schemes shifted India from an importer to a major mobile manufacturer. The smartphone market grew from $44.2 billion in 2023 to an expected $89.1 billion by 2032.

India climbed to the world’s third-largest mobile manufacturing exporter. Samsung and others achieved 7% year-on-year growth in Indian production, thanks to export strategies.

Some important policies:

- Jan Aushadhi-Common Service Centres: Digital services in remote areas

- Aadhaar integration: Easier mobile number verification

- UPI payments: Mobile-first financial transactions

- Digital literacy programmes: Training rural populations

The Phased Manufacturing Program gave local production a boost. This reduced imports and created new jobs.

Government services moved to smartphones. Now, people can do everything from passport applications to tax filing on their phones.

Mobile App Ecosystem and Usage Patterns

India’s mobile app ecosystem grew around what locals actually want and need. Usage patterns here look very different from Western countries.

Regional language support turned out to be a game-changer. The most successful apps offer content in Hindi, Tamil, Bengali, and other local languages—not just English.

Indians flock to apps in certain categories:

- Digital payments: Paytm, PhonePe, Google Pay are everywhere

- Entertainment: Short video apps eat up hours of attention

- E-commerce: Mobile-first shopping, often with cash-on-delivery

- Education: Online learning for competitive exams

Indians love video and social media. On average, people use over 20GB of data per month—among the highest in the world.

Mobile gaming has become huge. Games now earn more revenue than PC or console titles, with cricket and fantasy sports leading the way.

A lot of small businesses use WhatsApp and Instagram to sell directly, skipping traditional e-commerce sites.

The app boom created millions of jobs, from delivery drivers to content creators, in both cities and villages.

Trends Shaping the Indian Smartphone Market

Three big shifts are changing India’s smartphone market. Over half of all new phones now support 5G, and buyers want better cameras and faster charging.

5G Smartphone Adoption and Market Share

5G smartphones now make up more than 55% of all phones shipped in India during 2025. That’s a massive jump as more cities get 5G coverage.

Chinese brands are leading this 5G wave. Xiaomi’s Redmi series brings affordable 5G models starting at around ₹12,000, making fast speeds available to budget buyers.

Realme goes after young, tech-hungry customers with low prices on 5G phones. They pack 5G into devices under ₹15,000, which is wild if you think about it.

People want future-proof phones. Nobody’s keen to buy a 4G phone when 5G is rolling out everywhere.

Network operators are pushing 5G too. They offer better data plans and incentives, which keeps the sales momentum going.

Premiumisation and Fast-Charging Innovations

Indian buyers are spending more on smartphones now. The entry-premium segment (₹15,000-₹30,000) has grown over 35% as people look for better cameras and performance.

Fast charging is a major selling point. Phones with 65W, 80W, or even 120W charging are now common in mid-range devices.

Brands compete hard on charging speed. What used to take two hours now finishes in 30 minutes—a big deal for heavy users.

Cameras matter a lot for people upgrading. Multi-lens setups, night mode, and AI features make higher prices feel worth it.

People also care about how their phones look and feel. Sleek designs and premium finishes help brands stand out and charge more.

Rise of Entry-Premium and Mass Budget Segments

The ₹15,000-₹30,000 price range is booming. It offers flagship features without the flagship price, and millions are upgrading.

Phones under ₹10,000 still sell in huge numbers. First-time buyers and rural users keep this segment growing.

Brands tailor their strategies for both. Samsung’s Galaxy A series handles premium, while Galaxy M goes after the budget crowd.

People shop differently depending on what they want. Premium buyers often research online but buy in stores; budget buyers are moving to e-commerce.

Rural buyers want long battery life and sturdy phones. Urban users care more about cameras and gaming.

Top Smartphone Brands Leading Indian Market

In 2025, established brands like Vivo, Samsung, and Xiaomi lead in units sold, while premium players Apple and OnePlus drive revenue growth. Chinese brands still hold strong positions thanks to aggressive pricing and local production.

Dominance of Vivo, Xiaomi, and Samsung

Vivo tops India’s smartphone shipments with a 22% market share in Q1 2025, shipping 7 million units. The brand grew 13% year-on-year by focusing on Tier 2 and Tier 3 cities and building strong offline networks.

Vivo’s steady pricing in the ₹12,000-₹20,000 range works well. Models like the Vivo T2x and Y-series are popular for their battery and camera upgrades.

Samsung holds 16% market share, shipping 5.1 million units in Q1 2025. Even with a 23% drop in shipments, Samsung keeps strong revenue through its premium Galaxy S-series.

Samsung’s factories in Noida and Tamil Nadu help keep costs down. The Galaxy M and A-series serve the mid-range market.

Xiaomi hit some rough patches, dropping 38% year-on-year to 12% market share. The brand shipped 4 million units and faces challenges with its online-first strategy.

Still, Xiaomi stays competitive in the ₹8,000-₹15,000 segment. But many users now want better support and camera quality.

Impact of OPPO, realme, and OnePlus

OPPO holds 12% market share with 3.9 million units shipped and 5% growth. BBK Electronics, OPPO’s parent, uses a huge offline retail network to reach Indian cities.

OPPO focuses on design and fast charging. They target buyers who want premium features without the high price.

Realme has 11% market share with 3.5 million units and 3% growth. The brand mixes online sales with select offline partnerships.

Realme positions itself as a value pick. Their phones offer solid specs and pricing that appeals to younger users.

OnePlus takes a different approach, going for the premium crowd. It doesn’t lead in shipments, but it has strong loyalty among enthusiasts.

Their “flagship killer” label attracts people looking for a high-end Android experience. OnePlus phones usually cost between ₹30,000-₹60,000.

Emergence of Apple and Motorola

Apple saw big growth, even though it’s not in the top five for shipments. The brand shipped around 2.8-3.1 million units but grabbed a 26% revenue share in Q1 2025.

That’s a 29% jump in revenue year-on-year, making Apple the leader in India’s smartphone revenue. Local assembly helps Apple lower costs while staying premium.

Apple’s EMI options, trade-ins, and growing appeal with professionals are helping too. The iPhone 15 and SE models are driving adoption at different price points.

Motorola is making a comeback in India. Lenovo owns the brand, and they focus on a near-stock Android experience and good pricing.

Motorola goes after users who want clean software and regular updates. Their phones appeal to folks who want reliable performance without bloat.

Nokia still has a small but loyal following, managed by HMD Global. Nokia emphasizes durability and Android One software for consistent updates.

Brand Success Stories and Strategies

Chinese brands shook up India’s mobile market with their own unique playbooks. Xiaomi grabbed the spotlight by pushing value-driven phones and clever sub-brands, while Vivo doubled down on retail stores and camera tech to win over younger buyers.

Xiaomi’s Value Proposition and Sub-brands

Xiaomi shot up to the top of India’s smartphone charts with a pretty straightforward approach: pack phones with high-end specs, slap on a low price tag, and watch the buzz build.

They kicked off in India back in 2014, selling only online. This move cut out retail expenses, so Xiaomi could undercut rivals on price.

Key Success Factors:

- Flash sales whipped up excitement and urgency

- Direct online sales trimmed margins

- CEO Manu Kumar Jain took on a public role as the brand’s face on social media

- Specs mattered more than flashy design

Xiaomi’s sub-brands widened their net. POCO arrived in 2018, zeroing in on gaming enthusiasts with the F1—a phone that packed a flagship processor into a mid-range price.

POCO acts as its own brand now. They talk performance first and build tight-knit communities online. Cooling systems and gaming features became their calling cards.

Mi phones go after the mainstream crowd. POCO attracts performance junkies. This split keeps them from stepping on each other’s toes and lets Xiaomi scoop up different customer types.

Vivo’s Retail Expansion and Camera Innovation

Vivo walked a totally different path from Xiaomi. They made physical retail their superpower.

Vivo opened thousands of stores across India, especially in rural and tier-2 cities. People could walk in, try out phones, and buy on the spot.

Vivo’s Retail Strategy:

- Over 60,000 retail points all over India

- Strong ties with distributors

- Staff who speak local languages

- Quick after-sales support on the ground

Vivo’s marketing leans hard on camera tech. Their “Perfect Selfie” campaigns laser-targeted young adults aged 18-30. Bollywood stars helped spread the word.

Vivo phones roll out with advanced front cameras as a rule. Beauty filters, portrait lights, and AI features are baked in. These touches set them apart from Xiaomi’s spec-obsessed models.

Vivo pours money into cricket and entertainment sponsorships too. Their IPL title deal cost a fortune but made the brand a household name. Music and fashion tie-ups keep them relevant to the youth crowd.

Realme and POCO: Youth Appeal and Online Focus

Realme and POCO burst onto the scene as challengers, borrowing some of Xiaomi’s tricks.

Realme launched in 2018 as Oppo’s sub-brand. They didn’t just copy the online-first model—they added splashy colors and bolder ads.

Realme speaks straight to the 18-25 crowd. Their “Dare to Leap” campaigns talk about risk and ambition. Social media gets more love than old-school ads.

Realme drops new phones all the time. Monthly launches keep them in the news and offer something for every budget. Competitors really have to hustle to keep up.

POCO sets itself apart by focusing on gaming. They back esports tournaments and work with gaming influencers. Tech specs get detailed breakdowns for geeks and enthusiasts.

Both brands win by building communities. Online forums, social groups, and fan events turn buyers into loyalists. Fans end up promoting the brand themselves.

Their pricing stays sharp. Flash sales and limited-time deals keep that “best value” vibe alive—the same strategy that worked for Xiaomi at the start.

Telecom Operators Powering Mobile Connectivity

India’s telecom giants turned the country into a mobile-first powerhouse by rolling out networks everywhere and slashing prices. Now, over 1.17 billion people use their services, and India leads the world in data consumption.

Leadership of Bharti Airtel, Vodafone Idea, and Reliance Jio

Reliance Jio sits at the top with 481.8 million subscribers as of March 2024. They even overtook China Mobile in total network traffic, hitting 40.9 exabytes.

Jio’s 5G network already covers 108 million users on its True5G Standalone platform. Data traffic jumped 35.2% year-over-year, and 5G users account for 28% of that.

Bharti Airtel holds firm as India’s number two. They target premium users and businesses, all while rolling out 5G in big cities.

Vodafone Idea keeps going as the third biggest private player. Despite money troubles, they still serve millions across both urban and rural areas.

| Operator | Subscriber Base | Key Strengths |

|---|---|---|

| Reliance Jio | 481.8 million | Data traffic leadership, 5G coverage |

| Bharti Airtel | 380+ million | Premium services, enterprise focus |

| Vodafone Idea | 200+ million | Rural presence, competitive pricing |

Network Expansion and Rural Reach

Telecom operators built massive networks that now stretch into far-off villages and tribal regions. These connections bring digital services and e-commerce to places that used to be cut off.

Private companies poured money into 4G and 5G towers in rural India. Now, farmers can check weather, market prices, and government programs right on their phones.

Operators use creative fixes like satellite links and solar-powered towers to reach tough spots. These solutions keep costs down and networks reliable, even in tricky terrain.

Rural users are streaming more video and paying digitally like never before. Per-person monthly data use shot up from 13.3 GB to 28.7 GB in just three years—rural folks are driving a big chunk of that.

Role of Private and Public Telcos

BSNL (Bharat Sanchar Nigam Limited) stands as the main state-owned telco. They focus on government, defence, and rural areas where private firms don’t see much profit.

BSNL runs landline, broadband, and mobile, but really shines in remote regions. They keep vital networks online for emergencies and national security.

Private players like Jio, Airtel, and Vodafone Idea bring new tech and price wars. They made smartphones cheap, calls unlimited, and data super-fast.

This public-private mix keeps competition fierce and coverage broad. Private operators chase city and suburban profits, while BSNL keeps rural India connected.

Quick win: Before picking a plan, check which operator’s signal is strongest in your area using coverage maps. Rural users often get better reach with BSNL, but city folks usually prefer private companies’ faster data.

India’s 5G Revolution and Broadband Boom

India’s 5G rollout is on a tear. Data use is exploding—people now burn through 40GB a month, and the country could hit 770 million 5G users by 2028. The network already serves over 936 million internet users and keeps pulling in foreign investors.

Rapid Growth in 5G Subscribers and Coverage

5G adoption in India took off fast after launch. Nokia’s Mobile Broadband Index shows 5G data traffic tripled just in 2024.

Forecasts say India will hit 330 million 5G subscribers by 2026. The surge comes from people snapping up 5G smartphones and better network reach.

By 2028, that number could jump to 770 million. India’s on track to be one of the world’s fastest 5G adopters.

Rural areas are catching up, too. Tele-density hit 59.19% in March 2024. The Digital India program keeps pushing infrastructure into remote places.

Bharti Airtel and Reliance Jio lead the charge, pouring money into more 5G towers. Now, even small towns and villages get coverage.

Impact of 5G on Data Consumption Patterns

Once 5G landed, monthly data use shot up. Average users now go through 40GB every month—way up from 14.6GB in FY21.

By 2030, that could reach 62GB per month, which would be the world’s highest. Faster networks and more HD streaming are fueling the spike.

5G smartphones let people stream 4K videos, dive into cloud gaming, and use AR apps without a hitch. These features push up data use across all age groups.

Business users get a boost, too. Video calls, cloud storage, and remote work apps run way smoother on 5G.

Mobile operators now lean on data plans for revenue, not old-school voice calls.

India as the World’s Second Largest 5G Market

India’s telecom network ranks as the world’s second largest, with 1,199.28 million total subscribers as of March 2024.

The domestic mobile manufacturing scene is booming, churning out devices worth US$126 billion. That helps more people afford 5G phones.

Foreign Direct Investment hit US$39.32 billion from April 2000 to March 2024. The government’s 100% FDI policy in telecom keeps big global players interested.

Bharti Airtel, Vodafone Idea, Reliance Jio, and BSNL all battle for market share. This rivalry keeps prices in check and spurs innovation.

India’s BharatRAN project is building homegrown 4G/5G tech, reducing the need for foreign gear. This move boosts India as a telecom manufacturing hub and tightens up network security.

Mobile Consumer Behaviour and Demographics

Mobile habits in India really depend on where people live, how they shop, and their age. Young city dwellers lead the charge, while rural folks still lean on offline shopping even as they get more digital access.

Urban-Rural Digital Penetration

Urban India is way ahead in mobile use. About 85% of the most active users live in cities—mostly young men aged 18-34 who gobble up most of the country’s data.

Rural areas look different. Even though 63.4% of Indians live outside cities, only 52.4% of the total population uses the internet regularly.

This gap shapes habits. City users hop between apps all day and shop online a lot. In rural areas, families share phones and stick to voice calls more than texting.

Internet speeds tell the same story. Cities get median speeds around 94.62 Mbps, while rural connections lag behind.

Online Versus Offline Sales Channels

Mobile shopping has changed how Indians buy, but not everywhere. Urban millennials and Gen Z love the convenience and choices of shopping with their phones.

Online shopping behaviours include:

- Comparing prices on different apps

- Checking out reviews before buying

- Using mobile wallets and UPI

- Shopping during commutes or late at night

Rural shoppers still trust offline stores for big purchases. They’ll research on their phones but usually close the deal in person.

Trust is a big deal here. Urban buyers feel fine using digital payments, but rural folks often stick with cash or want to see the seller face-to-face.

Influence of Youth and First-Time Buyers

India’s population is super young—over 65% are under 35. This group buys the most new smartphones and downloads the most apps.

First-time buyers usually go for Android because it’s cheaper. They start with basics like WhatsApp and YouTube, then move on to shopping apps.

Key youth behaviours include:

- Entertainment focus: 67.6% of YouTube users are male, mostly under 30

- Social media adoption: 32.2% of people use social platforms actively

- Price sensitivity: Most pick phones under ₹15,000 for their first

Young buyers also influence their families. They help older relatives try mobile banking, online shopping, and digital entertainment for the first time.

Innovation and Premiumisation Trends

India’s smartphone scene is shifting fast toward pricier devices. Apple and Samsung are leading the charge. People are upgrading for new features like AI tools and super-fast charging, even if it means paying more for their next phone.

Rise in Premium Smartphone Segments

India’s premium smartphone market is on a tear lately. Market value shot up by 12% in Q3 2024, but the number of phones sold only crept up by 3%. People seem to be splurging on pricier devices.

Key Growth Drivers:

- Easy monthly payment plans (EMIs)

- Trade-in offers for old phones

- Rising incomes in cities

This premium segment is posting some wild growth numbers. In certain quarters, sales of premium phones more than doubled year-on-year.

Premium phones now make up a bigger chunk of total sales. Folks in smaller cities are jumping in too, not just buyers in Mumbai or Delhi.

Banks and phone brands have teamed up to make expensive phones seem affordable. With monthly payments as low as ₹2,000-3,000, people can pick up phones worth ₹50,000 or even more.

Premium Brand Strategies: Apple and Samsung

Samsung leads with a 23% market value share, mostly thanks to its Galaxy S series. The company has started adding AI features to cheaper Galaxy A models, nudging people to upgrade from basic phones.

Samsung’s AI tools now cover photo editing and language translation. These were once only in their fanciest flagships.

Apple holds a 22% value share and is pushing hard beyond big cities. The iPhone maker opened stores in Mumbai and Delhi in 2023, and plans four more in Bengaluru, Pune, Delhi-NCR, and another in Mumbai.

Apple’s recent wins come from strong iPhone 15 and 16 sales. The brand’s premium image really clicks with Indian buyers who see iPhones as status symbols.

Both companies are taking different routes:

- Samsung: Brings premium features to more affordable phones

- Apple: Expands physical stores and improves availability

Emergence of AI and Fast-Charging Features

AI is quickly becoming a must-have in Indian smartphones. Samsung is leading by adding artificial intelligence to phones under ₹30,000.

Popular AI features popping up everywhere:

- Smart photo enhancement

- Real-time translation

- Voice assistants

- Battery optimization

Fast-charging is another big draw these days. Many phones now support 65W to 120W charging speeds. Some premium models fill up in less than 30 minutes.

OnePlus kicked off the fast-charging race in India with Warp Charge. Other brands scrambled to catch up with their own super-fast charging.

AI-driven camera features make it easier to take great photos. Night mode, portrait effects, and video stabilization all work automatically now.

These upgrades make higher prices feel more reasonable. People are fine paying extra if the phone actually makes life easier or more fun.

Mobile Manufacturing and Make in India

India’s mobile manufacturing industry has really flipped the script—from relying on imports to becoming a production powerhouse. The Production Linked Incentive scheme pushed exports from just $0.2 billion in 2017-18 to $24.1 billion in 2024-25, creating over 17 lakh jobs and pulling in tons of foreign investment.

Growth of Domestic Smartphone Production

The mobile manufacturing scene exploded from just two units in 2014-15 to 300 by 2024-25. That’s a 150-fold jump in capacity.

India’s smartphone market hit $44.2 billion in 2023. Forecasts say it’ll reach $89.1 billion by 2032, growing at 8.1% a year.

The Production Linked Incentive (PLI) scheme kicked off in 2020 and made a huge difference. Mobile phone exports soared by an eye-popping 11,950% over seven years.

Domestic Value Addition (DVA) hit 23% by 2022-23. Local production processes generated more than $10 billion domestically.

Direct DVA climbed from $1.2 billion to $4.6 billion, a 283% rise. Indirect DVA from local suppliers grew even faster, up 604% to $3.3 billion.

Role of FDI and Local Assembly

Big Chinese brands like Xiaomi, Realme, and Oppo set up manufacturing plants in India. They now assemble phones locally instead of just importing them.

Foreign Direct Investment brought advanced manufacturing tech to the sector. International companies partnered with Indian firms to build hybrid production models.

Local and global manufacturers both ramped up operations. Companies started making components here, not just assembling parts.

The Phased Manufacturing Program (PMP) nudged firms to localize production step by step. This gave manufacturers time to build supply chains and stay competitive.

Local assembly plants now serve both Indian buyers and export markets. For some models, India is the main production hub.

Export Potential and Employment Impact

India’s electronics exports jumped 47% to $12.41 billion between April and June 2025. The US, UAE, and China are top buyers, with the US alone taking more than 60% of shipments.

Employment growth has matched the production boom. The mobile phone sector supported over 17 lakh jobs in 2022-23.

Export-linked jobs skyrocketed more than 33 times. Workers also got better wages as new jobs opened up.

Manufacturing jobs aren’t just sticking to big cities anymore. Smaller towns are getting factories, creating local work opportunities.

Export performance signals India’s deeper integration into global supply chains. We’re becoming a real alternative for manufacturing in Asia.

Export destinations have diversified, cutting reliance on any single market. Now, multiple countries regularly import Indian-made phones.

Challenges and Future Outlook for India’s Mobile Ecosystem

India’s mobile sector is a battleground—brands fight for attention, 5G isn’t cheap enough, and everyone’s eyeing 6G. These challenges will decide if India can hold on as a global mobile leader.

Competitive Landscape and Brand Battles

The Indian smartphone market in 2025 is a bit of a head-scratcher. There’s huge growth potential, but consumers seem more confused than ever.

Major challenges include:

- Handset sales dropping to recent lows

- Information gaps making regulation tricky

- Google’s Android OS dominating and warping the market

Chinese brands keep clashing with giants like Apple and Samsung. Apple touts India as its next big thing, but some industry numbers are worrying.

Experts talk about “exclusionary and exploitative conduct” from the big players. Smaller brands struggle, and buyers get fewer real choices.

Brand positioning headaches:

- Premium segment feels crowded

- Mid-range price wars are heating up

- Local manufacturing costs are going up

Manufacturers keep shifting tactics. Some double down on offline retail, while others bet everything on online sales.

5G Device Affordability and Network Readiness

5G adoption still faces hurdles in India’s price-sensitive market. Devices are just too expensive for most people.

Key affordability issues:

- Good 5G smartphones still cost over ₹15,000

- Network coverage sticks to big cities

- Most people don’t really know what 5G can do for them

Network infrastructure isn’t rolling out evenly. Urban areas get first dibs, while rural regions lag behind.

Infrastructure headaches:

- Delays in spectrum allocation

- Tower installation struggles in remote spots

- Power supply issues

Telecom operators are having a tough time with slow returns on investment. High spectrum prices don’t mean instant profits.

Most users still don’t get why 5G matters beyond faster speeds. Consumer education hasn’t caught up yet.

Government incentives help lower manufacturing costs, but imported components still keep final prices high.

Prospects for 6G and Advanced Connectivity

India wants to lead the 6G charge, even with current network gaps. Maybe those gaps could help us leapfrog into next-gen networks.

6G opportunities:

- Build new networks from scratch, skipping old tech

- Custom-fit infrastructure for future needs

- Tap into India’s software smarts

We’re seeing big investments in R&D. Government support is backing homegrown tech.

Strategic edges for 6G:

- Huge local market for testing

- Deep engineering talent pool

- Expanding manufacturing base

The telecom industry seems determined to adopt cutting-edge tech. India could become a real force in global communications.

Still, plenty of hurdles remain. We need to fix rural connectivity before 6G can really take off.

What matters most:

- Closing rural network gaps

- Making devices affordable

- Building business models that actually last

6G rollout will probably hinge on how well 5G does. Market readiness could make or break India’s global ambitions in advanced connectivity.

Frequently Asked Questions

India leads the world in mobile data use, with the average smartphone user burning through 32GB a month. With over 1.16 billion mobile subscribers, it’s the second-largest telecom market globally. This growth has shaken up e-commerce, banking, rural connectivity, and digital marketing all across the country.

How has mobile phone penetration impacted e-commerce growth in India?

Mobile phones have become the main way people shop online in India. Over half a billion internet users mostly use their phones—not computers—to browse e-commerce sites.

Cheap smartphones and affordable data plans have opened up online shopping to rural and semi-urban India. These areas used to have little access to regular retail stores.

Mobile payment systems built into shopping apps make buying stuff a breeze. People can shop, pay, and track deliveries right from their phones, no cards or cash needed.

What efforts are being made to improve mobile internet connectivity in rural regions of India?

The Indian government’s “Digital India” push has really focused on bringing mobile networks to rural areas. This effort has connected remote villages to the internet.

Big telecom players like Reliance Jio and Bharti Airtel have poured billions into building towers in rural regions. They see these markets as the next big subscriber base.

5G network expansion is now reaching rural spots, not just cities. By 2024, 5G covered 80% of India’s population, including many rural communities.

What are the leading mobile phone brands that have significantly influenced the Indian market?

Chinese brands dominate, grabbing about 70% market share in 2025. Xiaomi, Samsung, Vivo, and Oppo top the sales charts across price segments.

Samsung stands out as the biggest non-Chinese brand, holding strong in both budget and premium categories. Local manufacturing has helped keep its market presence solid.

Apple’s iPhone is getting more popular with higher-income buyers as purchasing power grows. Still, it sells far fewer units than Android brands.

How is the rise in mobile usage affecting the digital marketing landscape in India?

Mobile-first ads are now a must since users spend most of their digital lives on their phones. Brands design campaigns for mobile screens and swipe-happy habits.

Social media marketing has exploded on platforms like Instagram, Facebook, and local apps. These channels reach users directly on their phones all day long.

Short-form videos and mobile-friendly content are driving engagement through the roof. It’s working way better than old-school ads.

What policies has the Indian government implemented to support mobile technology advancements?

The “Make in India” campaign has pushed smartphone manufacturing inside the country. This move has created jobs and cut down on imports.

Spectrum allocation policies let telecom companies roll out 4G and 5G networks quickly. The government has offered radio frequencies at competitive rates to spur network growth.

Digital literacy programs help people use mobile tech more effectively. These efforts focus on rural areas and older folks who are new to smartphones.

In what ways is mobile banking transforming financial services within India?

Mobile banking has opened up financial services to millions of Indians who never had access before. People in rural areas don’t have to travel long distances just to visit a bank branch anymore.

Digital payment apps like UPI (Unified Payments Interface) really changed the game. Now, even small vendors and street sellers take mobile payments for everyday stuff.

More folks can get microfinance and small loans through mobile apps now. Small business owners and individuals find it way easier to access credit compared to the old-school banking routes.